Indian Council of World Affairs

Sapru House, New DelhiThe Chinese Electric Vehicle Industry : Where is it Headed?

Introduction

Amidst the ongoing US-China trade war, the US has levied a fresh set of tariffs on Chinese electric vehicles under Section 301 of the Trade Act of 1974. The tariff rate on EVs imported from China is set to increase from 25 per cent to 100 per cent in 2024. Simultaneously, the results of the EU’s anti-subsidy investigation into Chinese electric vehicles, citing concerns over market distortion and the impact of massive state subsidies, are set to be announced in the coming month.

This paper aims to assess the Chinese government’s interventionist approach in the EV sector, while considering the broader implications for the international market.

International Criticism and Tariff Impositions

The Chinese electric vehicle (EV) market has emerged as the largest in the world, with China accounting for more than 50 percent of global EV sales in 2023. The Chinese EV automaker Build Your Dreams (BYD) also overtook Elon Musk’s Tesla in the final quarter of 2023 as it outsold the American automotive and clean energy giant in battery-only cars.[1] This growing dominance by Chinese EV manufacturers has invited stark criticism from international quarters, as the rapid growth can be credited to heavy governmental involvement and reliance on national policies. While these policies are domestic in nature, they severely impact and, in turn, have significantly shaped international market dynamics.

European Commission President Ursula Von Der Leyen has previously openly criticised China’s flooding of global markets with “artificially low-priced electric cars” which was followed by the launch of an anti-subsidy investigation into the EVs coming from China in October of 2023.[2]

In contrast to the US’ tariff hikes from 25 per cent to 100 per cent, the EU’s move is likely to have greater repercussions as China exports a substantially larger quantity of EVs to the EU compared to the US.[3]

The US tariffs, on the other hand, aim to counteract what the U.S. administration views as extensive subsidies and non-market practices by China. The tariffs are in accordance, therefore, with the raising of American concerns about Chinese overcapacity by Secretary of Treasury Janet Yellen during her visit to China in April. However, these claims were completely dismissed by President Xi Jinping during the China-France-EU Trilateral meeting, during which he proclaimed that there is no such thing as “China’s overcapacity.”

Owing to the stark criticism that China has received from the international market actors, the role of the over indulging Chinese government and its policies have come under great scrutiny.

Role of the Government in the Chinese EV Sector

The growth of China's electric vehicle industry has been significantly driven by extensive government intervention and strategic initiatives since the early 2000s. Government-backed programmes, such as the "863 Program" marked the outset of strategic initiatives aimed at promoting new energy vehicles. The Chinese government’s national subsidies ended in 2023 as it marked the first year where the Chinese new energy vehicle sector functioned without state subsidy support. It is however important to note that other forms of state backed non-monetary policies still remain in place and the extension of the “Purchase tax reductions and Exemption Policy for New Energy Vehicles (NEVs)” till 31 December, 2025 is a representative case for the same.[4]

EV consumers in China have been beneficiaries of government purchase subsidies for several years. From 2009 to 2022, China allocated over 200 billion yuan (equivalent to $28 billion) towards EV subsidies and tax breaks.[5] In 2022 alone, the country witnessed the sale of more than six million EVs, accounting for half of all global EV sales. As a result, oversupply has emerged as a significant issue, with over 200 manufacturers struggling to manage excess inventory. The National Development and Reform Commission (NDRC) of China has issued warnings about intense competition within the new energy vehicle sector, projecting a flood of EVs hitting the market in 2024.[6] With expectations of more than 110 new NEV models launching in 2024, the competition is set to escalate, further exacerbating the oversupply issue.

Consequently, Chinese companies, such as Build Your Dreams (BYD), NextEV (NIO) and Xiaopeng Motors (XPeng) have not only flooded the domestic market but also have aggressively expanded their international presence, underscoring the pervasive reach of these state-backed enterprises.

Implications of Tariffs and Future Directions

The future of China's electric vehicle industry is set to be shaped by government strategies as responses to tariff impositions. The possibility of European Union tariffs has forced responses from Chinese officials, who have expressed concerns over the prospect of heightened economic and trade tensions. The recent visit by Chinese Commerce Minister Wang Wentao to Spain furthered China's determination to safeguard its interests amidst evolving trade dynamics. He stated,"Accusations of ‘unfair competition’ against China are groundless. Fair competition is the consensus of all countries and the cornerstone of international exchange, and it cannot be defined by a few countries.”

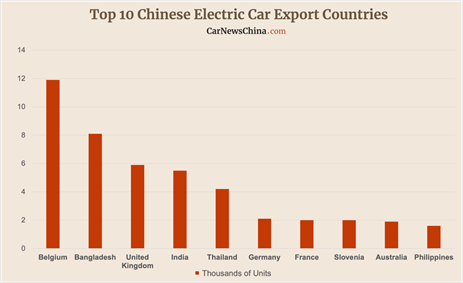

The implications of potential EU tariffs on Chinese EVs will have great consequences, given the existing tariffs imposed by the United States. Since four of the top ten destinations for Chinese electric car exports are in the EU, the implications of these tariffs gets further exacerbated. According to a Bloomberg report, EU tariffs on Chinese electric vehicles would potentially result in a significant impact on Beijing's trade with the bloc, with projected losses amounting to nearly $4 billion. The analysis suggests that the imposition of a 20 per cent import tariff by Brussels could lead to a 25 per cent reduction in the number of Chinese EVs imported to the EU, equivalent to approximately 125,000 vehicles.[7] Simultaneously, a Reuters report noted that Brussels has indicated that it will address excessive subsidies with additional tariffs ranging from 17.4 per cent for BYD to 38.1per cent for SAIC, on top of the standard 10 per cent car duty.[8]

Domestically, the Chinese government has laid out ambitious plans to support the EV industry's growth, including constructing a country-wide charging infrastructure capable of supporting 20 million EVs by 2025. This infrastructure investment is part of a broader effort to ensure that 50 per cent of all car sales in China will be EVs by then. Technological innovation has always remained at the heart of China's EV strategy, as significant R&D investments are expected to drive breakthroughs in battery technology, autonomous driving, and artificial intelligence. For example, in China, the cost of raw materials like nickel, lithium, and cobalt is decreasing, which is anticipated to reduce the overall cost of EV batteries. According to a Goldman Sachs report, battery costs account for 30 per cent of total EV manufacturing costs but are expected to drop to 15–20 per cent by 2030–2040.[9]

[According to data released by the China Association of Automotive Manufacturers (CAAM) on 17 February, new energy vehicle (NEV) exports from China are primarily directed towards ten countries. Among these, Belgium, Bangladesh, and the United Kingdom emerged as the top three destinations for Chinese NEV exports. Source: "CarNewsChina" article titled "Top 10 Chinese Electric Car Export Countries Revealed," published on 21 February, 2022.]

Chinese companies are also forming strategic partnerships and acquiring stakes in renowned automakers to enhance global competitiveness and scale production. Many Chinese EV companies plan on expanding to the Middle East with continuing sales in countries such as Bangladesh, one of the top three destinations for Chinese NEV exports alongside Belgium and the United Kingdom. The proliferation of EV manufacturers and ambitious production targets, may lead to pricing pressures and quality concerns, potentially undermining long-term sustainability and profitability.

Conclusion

The Chinese electric vehicle (EV) industry has rapidly emerged as a global leader, capturing over 50 per cent of global EV sales in 2023. At the same time, major Chinese manufacturers like BYD, NIO, XPeng, and Geely have established themselves as industry leaders, and concerns exist over market saturation, supply chain dependencies, and mounting competition from international rivals. The convergence of the actions by the US and EU increases the broader challenges facing China's EV industry in navigating international trade dynamics and maintaining market competitiveness.

In the ever-evolving global electric vehicle industry landscape, China's trajectory remains a subject of keen observation and interpretation. As the nation grapples with challenges and seizes opportunities, its role in shaping the future of mobility will undoubtedly be a focal point of ongoing discourse and analysis.

*****

*Palkin Lamba, Research Intern, Indian Council of World Affairs, New Delhi

Disclaimer: Views expressed are personal.

Endnotes

[1] Dana Hull, Bloomberg. "Tesla Falls Behind BYD in Quarterly EV Sales as Growth Slows." Bloomberg, January 2, 2024. Accessed May 26, 2024. https://www.bloomberg.com/news/articles/2024-01-02/tesla-falls-behind-byd-in-quarterly-ev-sales-as-growth-slows.

[2] European Commission. "Commission Launches Investigation on Subsidised Electric Cars from China." European Commission, October 4, 2023. Accessed May 29, 2024. https://ec.europa.eu/newsroom/trade/items/802668/.

[3] Biden, Joseph R. "Memorandum on Actions by the United States Related to the Statutory 4-

Year Review of the Section 301 Investigation of China’s Acts, Policies, and Practices Related to Technology Transfer, Intellectual Property, and Innovation." May 14, 2024. Accessed May 17, 2023. https://www.whitehouse.gov/briefing-room/presidential-actions/2024/05/14/memorandum-on-actions-by-the-united-states-related-to-the-statutory-4-year-review-of-the-section-301-investigation-of-chinas-acts-policies-and-practices-related-to-technology-transfer-intellectua/.

[4] 财政部, 税务总局, 工业和信息化部. "关于延续和优化新能源汽车车辆购置税减免政策的公告." Last modified June 19, 2023. Accessed May 27, 2024. https://www.gov.cn/zhengce/zhengceku/202306/content_6887734.htm.

[5] "国务院办公厅关于促进新能源汽车发展的若干意见." 中国政府网. Accessed May 26, 2024.

https://www.gov.cn/zhengce/202306/content_6888094.htm.

[6] "China's electric vehicle industry faces fierce competition in 2024." CNN, April 24, 2024. Accessed June 3, 2024. https://edition.cnn.com/2024/04/24/business/china-ev-industry-competition-analysis-intl-hnk.

[7] Bloomberg. "EU Tariffs on EVs Would Cost China Almost $4 Billion in Trade." Bloomberg, May 31, 2024. Accessed June 2, 2024. https://www.bloomberg.com/news/articles/2024-05-31/eu-tariffs-on-evs-would-cost-china-almost-4-billion-in-trade.

[8] Blenkinsop, Philip. "EU to Impose Multi-Billion Euro Tariffs on Chinese EVs, FT Reports." Reuters, June 12, 2024. https://www.reuters.com/business/autos-transportation/eu-impose-multi-billion-euro-tariffs-chinese-evs-ft-reports-2024-06-12/.

[9] Goldman Sachs. "Even as EV Sales Slow, Lower Battery Prices Expected to Spur Widespread Adoption.” Goldman Sachs, February, 2024. Accessed May 30, 2024. https://www.goldmansachs.com/intelligence/pages/even-as-ev-sales-slow-lower-battery-prices-expect.html.