Indian Council of World Affairs

Sapru House, New DelhiIndia-Singapore Semiconductor Supply Chain: Complementary and Resilient

Abstract: Singapore’s best practices in the semiconductor ecosystem offer scope for synergy with India’s expanding semiconductor sector by exploiting their complementarities and developing resilience in semiconductor supply chains at the bilateral level, which will contribute to strengthening the global semiconductor market.

Introduction

The advancement in semiconductor technology and its strategic applications across sectors have made countries “race for semiconductors”. In contrast to semiconductors, traditional electronic components are expensive, less efficient, reasonably large, and more carbon-emitting. According to the Semiconductor Industry Association, semiconductors produce complex integrated circuits (ICs), or microelectronic chips, that control modern electronics and are essential to the technologies for various industries globally. Advanced semiconductors drive the rise of emerging technologies like the Internet of Things (IoT), 5G networks, Artificial Intelligence (AI), autonomous driving, and electric vehicles (EVs).

India and Singapore are in this race to improve and strengthen their participation in semiconductor supply chains, which are indispensable to the global electronics market valued at $3 Trillion in 2022.[i] They represent a total semiconductor market value of $139 billion ($101 billion[ii] for Singapore and $38 billion[iii] for India) in 2023. Singapore is already a global semiconductor hub, while India is in the initial phase of building the overall semiconductor ecosystem. The strengths of their semiconductor markets complement each other and attract global semiconductor businesses and investments, which can contribute to global semiconductor market resilience. Further, the geopolitical challenges, such as the US-China semiconductor war, have also contributed to relocation choices by global semiconductor businesses.

The two countries signed a Memorandum of Understanding (MoU) in the semiconductor ecosystem on 26 August 2024, which was exchanged between PM Modi and PM Lawrence Wong on 5 September 2024 during Modi’s visit to Singapore. It will strengthen their bilateral trade in semiconductors and diversify their supply chain sourcing. Singapore’s Home Affairs and Law Minister, K. Shanmugam, during his visit to Mumbai on 8 November 2024, said that Singapore is a “serious and reliable player” in the international semiconductor industry. The MoU partnership will enhance their semiconductor complementarities and competitiveness by exchanging the high-tech talent pool of both countries and their technical expertise, bringing Singapore’s technology investment and best practices in semiconductors production to India, collaborating across various stages of semiconductor supply chains, and synergising their overall supply chain networks.

Bilateral Semiconductor Supply Chain and Its Complementary

Singapore is India’s largest trade partner in Southeast Asia, and it was India’s 6th largest global trade partner in 2023-2024, with a total trade of $35.62 billion.[iv] India’s bilateral trade in semiconductor devices with Singapore shows that India imports semiconductor devices from Singapore with a value of $332 million, or 7.3 per cent, of its global imports in 2022, while its exports to Singapore are smaller than its imports, with the export value at $1.17 million, or 0.23 per cent of its total exports.

India and Singapore ventured into the semiconductor sector very early. The semiconductor industry in Singapore began in the 1960s. Singapore entered the semiconductor supply chain, starting with assembly, testing and packaging (ATP) and then moving to fabrication.[v] During this time, it rose in the semiconductor value chain, having the capacity for state-of-the-art and best-in-class manufacturing technologies. Singapore’s participation in the semiconductor ecosystem involves R&D, wafer fabrication, chip equipment production, assembly, testing, and packaging.

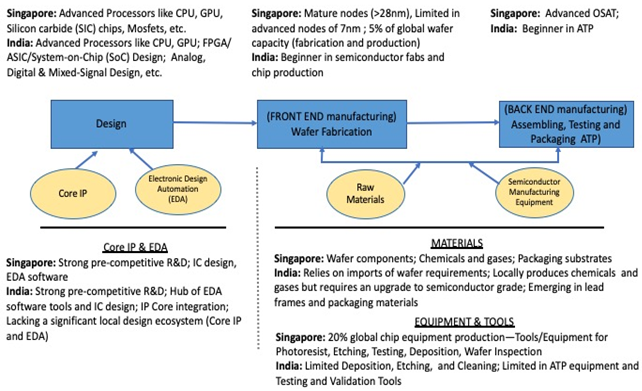

The semiconductor supply chain consists of five stages of production activities. It begins with pre-competitive R&D that develops the foundation for chip design and manufacturing technology.[vi] It is followed by IC design activity and then manufacturing through wafer fabrication and then putting them to assembling, testing and packaging as shown in Figure 1. The chip design stage can be divided into two activities, including (a) a production of intellectual property (IP) cores to design or build advanced ICs which is done by core IP companies, and (b) a production of specialised design tools and software which is done by electronic design automation (EDA) companies. And, the two manufacturing stages involve (a) a production of tools or equipment supplied by semiconductor manufacturing equipment (SME) suppliers, and (b) raw materials such as raw wafer, chemicals, gases, and other materials supplied by raw material suppliers.

Figure 1 locates supply chain activities (though not exhaustively) in India and Singapore, indicating a complementary relationship for semiconductor collaboration.

Figure 1: Semiconductor Supply Chain Activities in India and Singapore

Source: Adapted ‘basic structure of semiconductor value chains’ (UIBE, ADB, IDE-JETRO & WTO 2023); Ezell (2024)

In the R&D and chip design stages, India’s semiconductor industry is predominantly involved in precompetitive R&D and chip design[vii], which was the initial focus. Its R&D and chip design market is highly competitive, with the presence of top global semiconductor design companies like Texas Instruments, NVIDIA, and Qualcomm. In 1985, India’s first semiconductor R&D centre was established by Texas Instruments in Bangalore. However, its design and R&D segments lack domestic value addition in terms of low development of IP and EDA of its own. India is trying to address this, as about one-third of semiconductor startups are developing semiconductor IP. At the same time, about 66 per cent of them provide semiconductor-related services without owning or creating their IP.[viii]

Singapore has a strong IP regime that protects proprietary data, which is crucial for innovation and confidence of global chip design companies, and foreign direct investment (FDI) in R&D. The country has nine out of fifteen world-class chip design companies.[ix]

In the manufacturing stages, Singapore’s semiconductor ecosystem specialises in front-end and back-end semiconductor manufacturing in fabless foundries, integrated device manufacturers (IDMs), equipment makers, and Outsourced Semiconductor Assembly and Tests (OSATs). It has 25 semiconductor manufacturing capabilities (i.e., foundries). In the front end of semiconductor manufacturing, Singapore’s semiconductor industry produces wafers in semiconductor foundries.

Wafer fabrication is a crucial stage after which chips are carved out from wafers. Singapore contributes about 5 per cent of the global wafer capacity, 20 per cent of global semiconductor equipment production, and 10 per cent of the global total semiconductor output.[x] Its highly skilled semiconductor workforce constitutes about 35,000. Its semiconductor sector has high-value components, including radio frequency filters and semiconductor ICs.[xi] It produces silicon carbide (SiC) chips, third-generation semiconductors that power applications like EVs and data centres. Singapore also produces SIC metal-oxide-semiconductor field-effect transistors (Mosfets), which, also for SiC chips, are critical for the battery management system in EVs.

Singapore currently produces mature-node chips, i.e., older generation nodes of fabricated chips of 28 nm and above for smartphones, EVs, and industrial equipment[xii]. It has 20 semiconductor assembly and testing facilities. The focus is on climbing the segment's ladder[xiii] for advanced SME, chipmaking equipment and tools, and assembling, testing and packaging. Singapore is also looking forward to extend its expertise in all its semiconductor ecosystems to India, while the latter offers its vast market potential. It is interested in India’s development of assembly and testing stages, which will also benefit from the expected export growth for 2023–2030.[xiv] Global firms already have shown their interest in India for supply chain relocation due to its “large domestic consumer market, with a pipeline of projects across smartphones, automobiles, capital goods and semiconductor assembly and testing”. (Ibid.).

Thus, India’s market expansion offers Singapore new opportunities to invest and fill the knowledge gap in the capital and high-tech-intensive manufacturing segments (fabrication and ATP). It is relevant for both countries in India’s strategy of expansion from design to manufacturing activities, i.e., front-end manufacturing for wafer fabrication and back-end manufacturing for ATP, which relies on labour cost advantage and its large high-tech workforce. Moreover, India’s Semiconductor Mission aims to end its dependency in sending chip designs, prepared in the country, abroad for prototype development and testing due to a lack of foundries[xv]. This dependency comes despite India’s strengths in integrated chip designs. Singapore’s strong suit in infrastructure development of the two manufacturing segments can complement to India’s needs by exchanging its expertise in the semiconductor ecosystem. There is also a scope for Singapore to outsource lower-margin OSATs [xvi] to India given its plan to move up the semiconductor ladder while maintaining advanced packaging with profitable higher value additions. Overall, Singapore’s experience in the industry, starting its semiconductor journey from ATP, is crucial for India.

In terms of semiconductor skilled labour, India’s high-tech workforce now represents 20 per cent (over 125,000 workers) of the global semiconductor IC design workforce.[xvii] It produces about 3000 individual ICs per year. India’s collaboration has the potential to ease Singapore’s expensive manufacturing exports, which are facing challenges in the rising costs and global competition in the semiconductor market. India’s skilled workforce can be integrated into Singapore’s semiconductor value chain and address the increasing global demand for high-skilled labour. Through their collaboration, Singapore can support developing skilled workforce in India’s assembly and manufacturing segments, which are highly competitive and costly.

Moreover, India’s aim of reducing its reliance on component imports is also an opportunity for Singapore to contribute to building India’s domestic component supply base. India’s 62 per cent domestic electronic component requirements come from China.[xviii] However, according to the ITIF 2024 report, India’s hourly labour costs in ATP are within $0.01 of those of China. Further, its components and the sub-assembly segment are expected to create 10–50 per cent value addition opportunities. In 2022, India imported parts of semiconductors and similar devices from Singapore for about $25.5 million.[xix] Between 2021 and 2022, India ($43.4 million) and Singapore ($46 million) were among the fastest-growing importers of parts of semiconductor devices and similar devices.

In the long run, India and Singapore can exploit the growing automotive and AI end markets at the domestic and global levels. In contrast, the PC and smartphone end markets will soon mature. A large portion of this segment will get a demand boost for advanced chips, for the two countries are aiming to achieve net-zero sustainable development goals by adopting EVs, which contain more chips (above 3000 in number)[xx] than non-EVs (about 50–150 chips), on a large scale. The Indian EV market has become a preferred design and manufacturing base for most global automobile Original Equipment Manufacturers (OEMs) for local sourcing and exports.[xxi] Then, the growth of generative AI applications like ChatGPT is creating an increasing demand for advanced chips such as graphic processing units, central processing units, and application-specific ICs. According to Statista Market Insights, the global generative AI market will grow exponentially at a CAGR of 46.5 per cent from $20.5 billion in 2023 to $356 billion by 2030.[xxii] India’s expanding generative AI chip market provides an opportunity to collaborate with Singapore, which has a significant presence in the generative AI chip market.

Policy Environment

The government’s role is critical in the overall supply chain ecosystem, ranging from basic semiconductor research to building infrastructure. National semiconductor policies are focusing on bringing Singapore’s expertise in the semiconductor ecosystem and India’s potential to grow in the sector, offering immense scope to prepare for resilience in the semiconductor supply chain. The policy intention of India and Singapore is clear from the incorporated MoU on the semiconductor ecosystem and several joint venture projects (approved and in the pipeline).

India’s semiconductor policy is based on fulfilling the objective of self-sufficiency by developing value-added capacity in the semiconductor supply chain, while it is also proactively creating a favourable policy environment for global players to establish their businesses in the country. On 11 September 2024, Prime Minister Modi stated at the SEMICON India 2024, “Our dream is that every device in the world will have an Indian-made chip. India is set to play a major role in driving the global semiconductor industry.”

The government of India is incentivising businesses and investments under the National Policy on Electronics of 2019 across all stages of the semiconductor supply chain. The schemes will further the development of design and R&D and outsource India’s semiconductor ecosystem. India’s semiconductor received a massive push with the launching of the India Semiconductor Mission in 2021 under the “Make in India” initiative with a budget of $10 billion. It provides fiscal support of up to 50 per cent to manufacturing display and semiconductor fabricators. The Display Fabs in India provides fiscal support for up to 50 per cent of the project cost. Then, the Design Linked Incentive Scheme (DLI) promotes semiconductor design development and deployment. Under the DLI scheme, the Product DLI provides a 50 per cent subsidy to capital expenditure, and the Deployment Linked Incentive provides a subsidy of 4–6 per cent of revenues over five years. India Semiconductor Mission initiatives aim to build a resilient domestic ecosystem in pre-competitive R&D and chip design through partnerships among stakeholders, including governments, industry, academia, and global players.

Recently, the Research, Innovation, and Enterprise (RIE) 2025 Plan “remains a cornerstone of Singapore’s development into a knowledge-based, innovation-driven economy and society”. Under the plan, Singapore’s semiconductor ecosystem got a boost from operationalising the National Semiconductor Translation and Innovation Centre (NSTIC)[xxiii] in April 2024. It received a fund of about 180 million to “foster ecosystem collaboration and open new possibilities in enhancing the performance, efficiency and functionality of semiconductor devices”.[xxiv] (Ministry of Trade and Industry 2024: 8). It establishes the best practice in providing a common platform for semiconductor manufacturing to researchers and companies, including scientists and engineers, cleanroom facilities and industry-ready equipment. NSTIC allows companies to seamlessly integrate activities in the semiconductor supply chain, such as translational research and development, semiconductor prototyping, testing, and small-volume manufacturing.

The semiconductor companies can access NSTIC’s IPs developed by A*STAR, NTU, NUS, and SUTD. Now, companies can produce faster product prototyping and scale up manufacturing with the help of NSTIC’s capabilities of small-volume manufacturing, thereby further accelerating the process from market testing to the final launch of the products.

In cultivating a strong pool of skilled talent, the two countries have instituted policies that bring all stakeholders together. Singapore successfully established the government, industry, and academia together through initiatives like the Career Conversion Programme. From 2016 to 2023, the programme placed above 2,500 mid-career professionals in the semiconductor industry.[xxv]

India is set to become the most significant global market for a tech-savvy young population, constituting 26 per cent of the world’s largest population for the 15–29 age group and another 26 per cent for the 0–14 age group.[xxvi] Moreover, India is the second-largest mobile phone manufacturer in the world, and it is contributed by more than 200 mobile manufacturing plants in the country. Mobile manufacturing is behind India’s electronic exports growth by 50.5 per cent from 2022 to $23.57 billion in 2023.[xxvii] According to International Monetary Fund projections, the potential growth in the electronics sector is driven by the optimistic forecast of a per capita GDP of $3000 by 2025 on the back of India becoming the third largest economy by 2028 with an estimated nominal GDP of $5.58 trillion.[xxviii]

India’s AI semiconductor market alone will likely become $21 billion by 2030.[xxix] The market projection is based on the increasing need for semiconductors due to the expansion of 5G networks, growing demands for EVs, widespread use of IoT in healthcare, agriculture, and smart cities, and AI and machine learning. India’s semiconductor ecosystem consists of over 100 semiconductor start-ups, growing at 2.4 per cent year-on-year since 2014.

Semiconductor Supply Chain Disruptions

The strategic significance of semiconductors to a wide range of industries has caused countries to be concerned about disrupting trends to supply chains, which are characterised by global interdependencies. Such disruptions range from global pandemics to geopolitical conflicts. During the global COVID-19 pandemic, the lockdowns, widespread factory shutdowns and shipping delays limited chip production, affecting the automotive, electronics,[xxx] and industrial manufacturing sectors. The situations further deteriorated due to geopolitical tensions, such as the Russia-Ukraine war and the Israel-Hamas conflict, adding vulnerabilities to the global supply chains. For example, the Russia-Ukraine war created a shortage of neon, the gas used in semiconductor production supply from Ukraine.[xxxi]

Moreover, the US-China semiconductor war through export and import restrictions has severe implications for a stable and reliable supply. Their trade confrontation led to a 0.1 per cent decline in the global GDP.[xxxii] In October 2022, the US imposition of export restrictions on AI and semiconductor technologies to China affected the semiconductor market. The US ban on exporting high-end AI chips, AI chip design, EDA software, SME, and equipment components was to limit the growth of China’s semiconductor industry.[xxxiii] On 3 July 2023, China reacted through a counter-export ban to the US of two key semiconductor raw materials—gallium and germanium- critical inputs to high-tech production of chips, solar panels, and EV batteries[xxxiv]. President Trump’s anti-China rhetoric in the run-up campaigns to his election casts shadows over the stability of global semiconductor supply chains.[xxxv]

India and Singapore Towards Semiconductor Resilience

Thus, to achieve resilience, several semiconductor businesses have opted to re-strategise through “friendshoring” or “derisking”, defined by the World Economic Forum as the rerouting of supply chains to countries perceived as politically and economically safe or low risk to reduce risks associated with supply chain disruptions by looking for alternative supply sources of semiconductor inputs or chips.

Given the West’s rerouting away from Chinese semiconductors and the favourable government policies to expand the semiconductor market, India is seen as a viable alternative “friendshoring”.[xxxvi] Several global semiconductor players have announced investments in India. From 2012 to 2023, the announced FDI in semiconductors in India has increased by 180 per cent on an aggregate basis.[xxxvii]

It has given opportunities to third-country beneficiaries as alternatives to China’s supply chains and products manufacturing, technology and trade logistics. India, Vietnam, Malaysia, Singapore, and Thailand benefitted from the trade diversion due to the overall losses of Chinese exports in the US market. US and Chinese semiconductor businesses shifted their production to these countries. The shifting of semiconductor supply chains is indicated by changes in US imports of semiconductors and materials from different countries, including India, during 2019–2023. In 2023, the US imports from India increased exponentially by $1.8 billion (1152 per cent) in 2019, while imports from the ASEAN market increased by $7.1 billion (25 per cent).[xxxviii]

Industry collaboration in the semiconductor sector involving global players can further the development and strengthening of local industries as they bring technology and investment, which are critical for the local industries. SEMICON India 2024, modelled after SEMICON Europa, was held from 11 to 13 September in New Delhi, a networking platform connecting local semiconductor businesses with leaders across the global semiconductor design and manufacturing supply chain. In 2023, the SEMICON exhibition brought about 40,000 visitors and 600 exhibitors.

During his recent Mumbai visit, Singapore’s Minister Shanmugam highlighted a potential semiconductor business collaboration with the Tata Group in equipment partnerships, green energy initiatives, and skill development.[xxxix] In September 2024, Tata Electronics signed an MoU with ASMPT Singapore for workforce training, advancing service engineering infrastructure, automation, spare supports and boosting R&D initiatives in wirebond, flip chip, advanced packaging, and integrated system packaging. It will promote energy and material efficiency while keeping sustainable growth in mind. Moreover, Singapore-based IGSS Ventures submitted proposals to the India Semiconductor Mission.

The Tata Group is investing about $3.21 billion to set up India’s first indigenous semiconductor assembly and test facility in Jagiroad, Assam, for applications across automotive, mobile devices, and AI. It will generate over 27,000 direct and indirect jobs and become operational by mid-2025. Assam’s close proximity to semiconductor packaging and testing hubs like Malaysia, Singapore, Vietnam, and Taiwan gives India a significant position in the semiconductor segment.

Tata Electronics, in collaboration with Taiwan’s Powerchip Semiconductor Manufacturing Corporation (PSMC), is set to establish India’s first semiconductor fab at an investment of about $11 billion in Dholera, Gujarat. PSMC will provide design and construction support through licensing a technology transfer to the Gujarat Fab, which, upon completion, will have a production capacity of 50,000 wafers per month involving 1,00,000 skilled jobs. PM Modi laid the foundation for the two Tata facilities at Jagiroad and Dholera. Other joint ventures in India include (a) CG Power and Renesas collaboration to establish a semiconductor plant in Gujarat’s Sanand and (b) Micron Technology began construction of a $2.75 billion assembly and test plant in Sanand, Gujarat.

Singapore, according to HSBC’s Hong Kong-based economist Justin Feng, is at the heart of “Asia’s supply chain reconfiguration” in the ASEAN region.[xl] In Singapore, Micron Technology has helped the country achieve a robust 10 per cent share in the high-end global memory market, including generative AI chips,[xli] which makes the country share a big pie of the worldwide memory chips market along with the dominant China and South Korea in this segment. Singapore has several investment and infrastructure projects announced in the recent past. Qualcomm has a test centre of excellence for design verification and failure analysis for new products and technologies. Other industry collaborations include Qualcomm, GlobalFoundries (US), STMicroelectronics (Switzerland), United Microelectronics Corp. (Taiwan), and Vanguard International Semiconductor (Taiwan). Joint ventures, for example, Taiwan’s VIS and the Netherlands’s NXP Semiconductors, announced in June 2024, aim to build a 300mm wafer fab with a total investment of about $7.8 billion.

Thus, India and Singapore are among the preferred destinations for semiconductor business relocation. Their critical geographic locations and global logistics networks constitute another contributing factor in attracting semiconductor relocation. In this context, the India-Singapore collaboration will expand access to global semiconductor supply chains. Singapore is a global supply chain connectivity hub with Southeast Asia’s largest air cargo hub and the world’s busiest transshipment seaport.[xlii] Its central position in Southeast Asia is an easy entry point to Asian semiconductor markets such as China, Taiwan, Japan, South Korea, and ASEAN.[xliii] It has been coordinating the logistics activities of Taiwan, Korea, Japan, and, recently, India. India’s strategic location in the Indian Ocean is a global connectivity between the Middle East, Europe, and West Africa from the western coast and Southeast and East Asia from the eastern shore.[xliv] Further, it serves as a transit sea route connecting Europe with East Asia.

Moreover, the policy factor for India and Singapore has strengthened their semiconductor industry through supportive policies and initiatives. The synchronisation of semiconductor policies under the MoU will further strengthen their semiconductor markets. The two countries have a strong trading partnership under the Comprehensive Economic Cooperation Agreement of 2005. Singapore can act as a “gateway” for India to access the Southeast Asian semiconductor market, which is undergoing a rapid transformation.

Conclusion

India’s semiconductor strategy to become a global semiconductor leader combines favourable industry policy and business collaboration among domestic and global semiconductor players. It will strengthen its position in the global semiconductor market and fill the semiconductor export potential gap. It complements Singapore’s goal of expanding its well-established semiconductor ecosystem, seeking to move higher value additions and strengthen its domestic capacity. The two countries are implementing policies and schemes at a rapid pace to avoid losing opportunities in the growing global semiconductor market.

Expanding industry cooperation in the semiconductor ecosystem can become a pillar of the India-Singapore bilateral relationship. The MoU in the semiconductor ecosystem is bringing the two semiconductor hubs, India’s chip designs and Singapore’s expertise across all stages of semiconductor production together, which can build resilience to global semiconductor supply chains and strengthen alternative supply sources to take advantage of the geopolitical situations. It has come when semiconductor businesses worldwide seek sourcing alternatives to reduce their dependency on China or geopolitically volatile East Asia. Moreover, India and Singapore exercise autonomy in foreign policy and have diplomatic relations with all nations, including the US and China.

*****

*Dr. Mehdi Hussain, Research Associate, Indian Council of World Affairs, New Delhi.

Disclaimer: Views expressed are personal.

Endnotes

[i] Ministry of Electronics and Information Technology. Modified Scheme for Setting up of Semiconductor Fabs in India. Notification. The Gazette of India: Extraordinary, IPHW Division, Ministry of Electronics and Information Technology, Government of India. W-38/21/2022-IPHW. Delhi: Controller of Publications, 4 October, 2022. https://www.meity.gov.in/writereaddata/files/Notification%20Modified%20Scheme%20for%20Semiconductor%20Fabs.pdf (Accessed September 07, 2024).

[ii] ASEAN Briefing. “What Makes Singapore a Prime Location for Semiconductor Companies” (2024). https://www.aseanbriefing.com/news/why-singapore-is-the-top-choice-for-semiconductor-companies-in-2024/#:~:text=Singapore%20plays%20a%20vital%20role,of%20the%20global%20wafer%20capacity. (Accessed October 29, 2024).

[iii] Ministry of Electronics & IT. “Assam’s Semiconductor Plant: A Game-Changer for India’s Semiconductor Ecosystem” (Delhi: Press Information Bureau, Government of India, 2024). https://pib.gov.in/PressReleaseIframePage.aspx?PRID=2074074#:~:text=Industry%20estimates%20place%20the%20Indian,to%20$109%20billion%20by%202030. (Accessed November 25, 2024).

[iv] Ministry of Commerce & Industry. “Commerce Minister Piyush Goyal Holds Discussions on Expanding India-Singapore Economic Collaboration through Strategic Investment Dialogues,” (Delhi: PIB, August 25, 2024). https://pib.gov.in/PressReleasePage.aspx?PRID=2048809. (Accessed September 15, 2024).

[v] Stephen Ezell. Assessing India’s Readiness to Assume a Greater Role in Global Semiconductor Value Chains (Information Technology & Innovation Foundation, 2024) https://itif.org/publications/2024/02/14/india-semiconductor-readiness/?utm_source=chatgpt.com. Accessed September 29, 2024).

[vi] UIBE, ADB, IDE-JETRO & WTO. Global Value Chain Development Report 2023: Resilient and Sustainable GVCs in Turbulent Times, (UIBE, ADB, IDE-JETRO & WTO, 2023). (Accessed September 20, 2024).

[vii] Stephen Ezell. Assessing India’s Readiness to Assume a Greater Role in Global Semiconductor Value Chains (Information Technology & Innovation Foundation, 2024) https://itif.org/publications/2024/02/14/india-semiconductor-readiness/?utm_source=chatgpt.com. Accessed September 29, 2024).

[viii] Inc42. “The Rise of India’s Semiconductor Startups: Report 2024” (Inc42 Datalabs, 2024). (Accessed November 28, 2024).

[ix] TrendForce. “Overseas Expansion of Testing and Packaging Facilities – Japan, Malaysia, and Singapore Emerge as Top Choices” (Trendforce.com, April 29, 2024). https://www.trendforce.com/news/2024/04/29/news-overseas-expansion-of-testing-and-packaging-facilities-japan-malaysia-and-singapore-emerge-as-top-choices/. (Accessed October 09, 2024).

[x] EDB. “What Makes Singapore a Prime Location for Semiconductor Companies Driving Innovation?” (Singapore: EDB Singapore, August 20, 2024). https://www.edb.gov.sg/en/business-insights/insights/what-makes-singapore-a-prime-location-for-semiconductor-companies-driving-innovation.html. (Accessed October 20, 2024).

[xi] Speech by Mr. S. Iswaran, Minister for Trade & Industry (Industry), at the Opening of JTC Nanospace and Launch of the Electronics Industry Transformation Map on September 20, 2017, at 11 Tampines Industrial Crescent.

[xii] India Briefing. “India and Singapore Eye Future Growth in Semiconductors,” India Briefing, September 5, 2024). https://www.india-briefing.com/news/india-and-singapore-eye-future-growth-in-semiconductors-34293.html/. (Accessed October 25, 2024).

[xiii] At the same time, it has a limited footprint in advanced/most sophisticated nodes of 2 nm, 3 nm, or 5 nm segments. Singapore aims to strengthen its production capacity by entering edge logic and leading-edge memory chips segments.

[xiv] Varma Sonal. “Asia’s New Flying Geese” (Nomuraconnects, 2024). https://www.nomuraconnects.com/focused-thinking-posts/asias-new-flying-geese/. (Accessed October 01, 2024).

[xv] Stephen Ezell. Assessing India’s Readiness to Assume a Greater Role in Global Semiconductor Value Chains (Information Technology & Innovation Foundation, 2024) https://itif.org/publications/2024/02/14/india-semiconductor-readiness/?utm_source=chatgpt.com. (Accessed September 29, 2024).

[xvi] OSAT activities involve third-party packaging and testing services for semiconductors.

[xvii] Stephen Ezell. Assessing India’s Readiness to Assume a Greater Role in Global Semiconductor Value Chains (Information Technology & Innovation Foundation, 2024) https://itif.org/publications/2024/02/14/india-semiconductor-readiness/?utm_source=chatgpt.com. Accessed September 29, 2024).

[xviii] CII. Developing India as the Manufacturing Hub for Electronics Components and Sub-Assemblies (New Delhi: Confederation of Indian Industry, 2024). (Accessed December 23, 2024).

[xix] www.oec.world

[xx] EDB. “Big Hopes as Singapore Gears up to Ride EV Microchip Boom,” (EDB Singapore, February 04, 2024). “https://www.edb.gov.sg/en/business-insights/insights/big-hopes-as-singapore-gears-up-to-ride-ev-microchip-boom.html. (Accessed December 29, 2024).

[xxi] Ministry of Electronics and Information Technology. Annual Report 2023-2024 (Delhi: Ministry of Electronics and Information Technology, Government of India, 2024). (Accessed December 15, 2024).

[xxii] EDB. “Singapore Chipmakers See Growth Wave Amid Generative AI Boom,” (Singapore: EDB Singapore, May 09, 2024). https://www.edb.gov.sg/en/business-insights/insights/singapore-chipmakers-see-growth-wave-amid-generative-ai-boom.html. (Accessed December 29, 2024).

[xxiii] NSTIC is a national initiative led by the Agency for Science, Technology and Research (A*STAR), in partnership with the Nanyang Technical University (NTU), National University of Singapore (NUS), and Singapore University of Technology and Design (SUTD).

[xxiv] The $180 million funding becomes operational with the start of the RIE 2025 Plan. NSTIC “aims to foster ecosystem collaboration and boost R&D translation outcomes in the areas of flat optics and silicon photonics.” A*STAR. “National Fact Sheet for COS 2024: National Semiconductor Translation and Innovation Centre (NSTIC)” (Singapore: A*STAR, 2024). https://www.a-star.edu.sg/docs/librariesprovider1/default-document-library/cos2024/nstic-media-fact-sheet-for-cos-2024_final.pdf?sfvrsn=653e93eb_3. (Accessed October 20, 2024).

[xxv] Singapore Semiconductor Industry Association. Singapore Semiconductor Voice (Singapore: VOICE Magazine, Vol 31, 26 March, 2024). (Accessed December 15, 2024).

[xxvi] PwC. “India Calling: Decoding the Country’s Electronics Manufacturing Journey and the Way Forward” (Pricewaterhouse Coopers Private Limited, 2023). https://www.pwc.in/assets/pdfs/india-calling-decoding-the-countrys-electronics-manufacturing-journey-and-the-way-forward/india-calling-decoding-the-countrys-electronics-manufacturing-journey-and-the-way-forward.pdf. (Accessed 29 September, 2024).

[xxvii] CII. Developing India as the Manufacturing Hub for Electronics Components and Sub-Assemblies (New Delhi: Confederation of Indian Industry, 2024). (Accessed December 23, 2024).

[xxviii] International Monetary Fund. DataMapper. https://www.imf.org/external/datamapper/ngdpd[at]weo/OEMDC/ADVEC/WEOWORLD?year=2028, cited in PwC. “India Calling: Decoding the Country’s Electronics Manufacturing Journey and the Way Forward” (Pricewaterhouse Coopers Private Limited, 2023). https://www.pwc.in/assets/pdfs/india-calling-decoding-the-countrys-electronics-manufacturing-journey-and-the-way-forward/india-calling-decoding-the-countrys-electronics-manufacturing-journey-and-the-way-forward.pdf. (Accessed 29 September, 2024).

[xxix] Inc42. “The Rise of India’s Semiconductor Startups: Report 2024” (Inc42 Datalabs, 2024). https://asset.inc42.com/reports/The_Rise_Of_India’s_Semiconductor_Startups_Report_2024.pdf. (Accessed 02 October, 2024).

[xxx] Wei Xiong, David D. Wu and Jeff H.Y.Yeung. “Semiconductor Supply Chain Resilience and Disruption: Insights, Mitigation, and Future Directions,” International Journal of Production Research (2024) pp.1-24 (Assessed 04 December, 2024).

[xxxi] Heather Wishart-Smith. “The Semiconductor Crisis: Addressing Chip Shortages and Security” (Forbes, July 22, 2024). https://www.forbes.com/sites/heatherwishartsmith/2024/07/19/the-semiconductor-crisis-addressing-chip-shortages-and-security/. (Accessed November 27, 2024).

[xxxii] Eddy Bekkers and Sofia Schroeter. An Economic Analysis of the US-China Trade Conflict (World Trade Organisation, 2020). (Accessed November 11, 2024).

[xxxiii] Lili Yan Ing, “ASEAN in the Global Semiconductor Race” (ERIA 2023). (Accessed 24 October 2024).

Similarly, Japan and the Netherlands also followed the export control restricting the export of semiconductor technology to China on the grounds of national security.

[xxxiv] Lili Yan Ing, “ASEAN in the Global Semiconductor Race” (ERIA 2023). (Accessed 24 October 2024).

[xxxv] Mehdi Hussain. “Spill-over of Trump’s Anti-China Trade Stance” (Hindustan Times, November 23, 2024). https://www.hindustantimes.com/ht-insight/international-affairs/spillover-of-trump-s-anti-china-trade-stance-101732340153906.html. (Accessed December 02, 2024).

[xxxvi] Prerana Das, Suyesha Dutta and Deeplina Banerjee. “India Vies to Become Semiconductor ‘Superpower’ as FDI Pours In,” (Canada-Asia Sustainability Tracker, September 20, 2023). https://www.asiapacific.ca/sites/default/files/publication-pdf/Insight_SA_Sept20_V2.pdf. (Accessed December 20, 2024).

[xxxvii] Apratim Gautam et al. The Geopolitics of Supply Chains (Lazard Geopolitical Advisory, 2024) https://www.lazard.com/media/d4dnwbvc/the-geopolitics-of-supply-chains.pdf. (Accessed 21 December, 2024).

[xxxviii] Apratim Gautam et al. The Geopolitics of Supply Chains (Lazard Geopolitical Advisory, 2024). https://www.lazard.com/media/d4dnwbvc/the-geopolitics-of-supply-chains.pdf. (Accessed 21 December, 2024).

[xxxix] The Economic Times. “Tata to Collaborate with Singapore in Semiconductor Sector,” (The Economic Times, November 08, 2024). https://economictimes.indiatimes.com/industry/cons-products/electronics/tata-to-collaborate-with-singapore-in-semiconductor-sector/articleshow/115090473.cms?utm_source=chatgpt.com&from=mdr (Accessed November 18, 2024).

[xl] EDB. “Singapore Wins More Investments from Major Chipmakers as They Seek to De-risk Supply Chains” (Singapore: EDB Singapore July 12, 2024). https://www.edb.gov.sg/en/business-insights/insights/singapore-wins-more-investments-from-major-chipmakers-as-they-seek-to-de-risk-supply-chains.html. (Accessed December 21, 2024).

[xli] “Singapore Chipmakers See Growth Wave Amid Generative AI Boom” (EDB Singapore, May 09, 2024). https://www.edb.gov.sg/en/business-insights/insights/singapore-chipmakers-see-growth-wave-amid-generative-ai-boom.html. (Accessed December 29, 2024).

[xlii] EDB. “Media Factsheet,” (Singapore: EDB Singapore, October 03, 2024). https://www.sgpc.gov.sg/api/file/getfile/Media%20Factsheet-Singapore%20Supply%20Chain%20Connect%202024.pdf?path=/sgpcmedia/media_releases/edb/press_release/P-20241003-1/attachment/Media%20Factsheet-Singapore%20Supply%20Chain%20Connect%202024.pdf. (Accessed November 01, 2024).

[xliii] ASEAN Briefing. “What Makes Singapore a Prime Location for Semiconductor Companies” (2024). https://www.aseanbriefing.com/news/why-singapore-is-the-top-choice-for-semiconductor-companies-in-2024/#:~:text=Singapore%20plays%20a%20vital%20role,of%20the%20global%20wafer%20capacity. (Accessed October 29, 2024).

[xliv] India Briefing. “Why Foreign Businesses Relocate to India” (India Briefing, n.d.). https://www.india-briefing.com/doing-business-guide/india/why-india/why-do-foreign-business-relocate-to-india. (Accessed November 11, 2024).